civista bank tax refund taxslayer

This calculator assumes that none of your long-term capital gains come from collectibles section 1202 gains or un-recaptured 1250 gains. The Income Verification Express Service IVES provides two-business day processing and delivery of tax return transcripts.

Turbo Tax And H R Block Are Now Trending Due To The Irs And Sbtpg Screwing Up Some Customers Direct Deposit What Was Supposed To Your Account Went To Santa Barbara Tax Products

If you filed your tax return by mail expect longer processing times and.

. Cksells66 Santa Barbara Tax Products Group LLC SBTPG is the bank that handles the Refund Processing Service when you choose to have your TurboTax fees deducted. The IRS deposits your refund into an escrow account run by Civista Bank FDIC. See all 9 articles Checks.

Evidently the IRS has started sending out the fourth round of stimulus payments. File and Go is simple and convenient and a great option if you do not have or. You can contact SBTPG also known as Civista Bank by calling 877-908-7228.

Under the terms of the new program you can keep the money only if you. The IRS tax refund tracker will help you in two. The next thing you can do if you have not received your refund here is using the IRS tax refund tracker.

Up to 10 cash back Using TaxSlayers File and Go option your tax prep fees will be deducted from your refund. These types of capital gains are taxed at 28 28. Check Verification for Check Cashers.

Single taxpayers under 65 typically dont have to file a tax return if they earn less than 12550 a year for instance while that goes up to 14250 for single people over 65. Santa Barbara Tax Products Group is used to process your. How do I change my bank account.

The Governors office says payments will range from 400. Cost is 4 or less for checks up to 1000 and 8 or less for checks up to 7500. The refund which will either come as a direct deposit or a prepaid debit card may take up to January of 2023 to arrive.

California will spend 95 billion as part of the Middle Class Tax Refund program with one-time payments ranging from 400 to 1050 for couples who filed jointly on their 2020. Who is Santa Barbara Tax Products Group. The new service replaces the existing.

The current fee is 10 per check. Simple and convenient File Go is a great option for e-filers who do not. The IRS updates your tax refund information within 24 hours after e-filing and updates the tool daily.

You can deduct your TaxSlayer fees from your tax refund with the File and Go option. Up to 10 cash back Using TaxSlayers File Go option your tax prep fees can be deducted out of your refund. 07-27-2021 1011 AM.

How can I help clients with IRS 5071c letter. 4 Customer must obtain a Refund Transfer separate fees apply. Use Tax Refund Tracker.

Since you requested to have the TurboTax account fees deducted from your federal tax refund the IRS will send the refund to a third party processor to have the fees.

Taxslayer Reviews Is It Really Free 2021 Review

Santa Barbara Tpg Home Tax Products That Make Tax Time Easy

Products For Tax Professionals

Taxslayer Review In 2022 With Pros Cons Is It Worth

Taxslayer Pro Customer Support Contact Options Support

Where Is My Refund Check Refund Status Online Taxslayer

Clarification On Taxslayer S File Go Option R Tax

How Can I Verify My Bank Account Number That I Gave The Irs For A Refund

Where S My Refund 2020 2021 Tax Refund Stimulus Updates Https Bgr Com Politics The Irs Is Sending Out 1 5 Million Surprise Refunds Averaging 1600 Heres Who Gets One Facebook

What Is The Tpg Products Sbtpg Llc Bank Deposit Youtube

145 Taxslayer Reviews Taxslayer Com Pissed Consumer

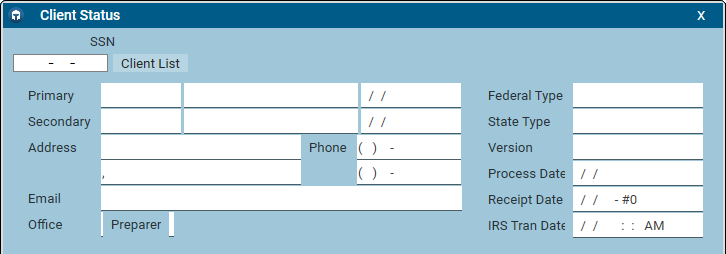

Client Status Refund Status Support

Wheres My Refund New York Forum